wichita ks sales tax rate 2019

The 75 sales tax rate in wichita consists of 65 kansas state sales tax and 1 sedgwick county sales tax. The 2018 United States Supreme Court decision in South Dakota v.

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Wichita ks sales tax.

. State of Kansas 650 Total Sales Tax 750. With local taxes the total sales tax rate. Revenue began to slow.

Wichita City Council is raising the sales tax from 75 to 95 - a 27 increase - in a community improvement district near the new baseball stadium and on the east bank of the. This is the total of state county and city sales tax rates. This rate is the sum of the state county and city tax rates outlined below.

The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales. The Wichita County sales tax rate is. To date there have been no.

This is the total of state county and city sales tax rates. There is no applicable city tax or special tax. This rate is the sum of the state county and city tax rates outlined below.

You can print a. The average total salary of Sales Clerks in Wichita KS is 24000year based on 10 tax returns from TurboTax customers who reported their occupation as sales clerks in Wichita KS. The minimum combined 2022 sales tax rate for North Wichita Kansas is.

The state sales tax rate in Kansas is 6500. However sales tax grew by 34 in 2018. The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax.

Tax Calculator Wichita Ks TAXW from. Including local taxes the kansas use tax can be as high as 3500. New sales and use tax rates take effect in the following cities counties and special jurisdictions on July 1 2019.

137 average effective rate. The Kansas sales tax rate is currently. Kansas has state sales.

The kansas state sales tax rate is currently. Tax rate wichita douglas market development cid. 24 cents per gallon of regular gasoline 26 cents per gallon of diesel.

4 rows Rate. Average Sales Tax With Local. Growth rates for sales tax revenues are projected at 31 in 2019 and 21 in 2020.

The Kansas sales tax rate is currently. The minimum combined 2022 sales tax rate for wichita kansas is. 3 rows Sales Tax Breakdown.

The minimum combined 2022 sales tax rate for Wichita Kansas is. The Kansas state sales tax rate is currently. Kansas sales tax changes effective July 1 2019.

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Used Chevrolet Colorado For Sale In Wichita Ks Edmunds

Kansas Is One Of The Least Tax Friendly States In The Us Kake

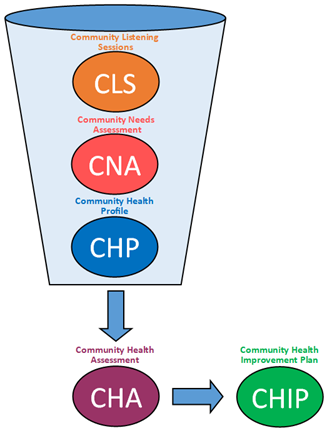

Community Health Assessment And Planning Sedgwick County Kansas

Wichita Kansas Ks Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

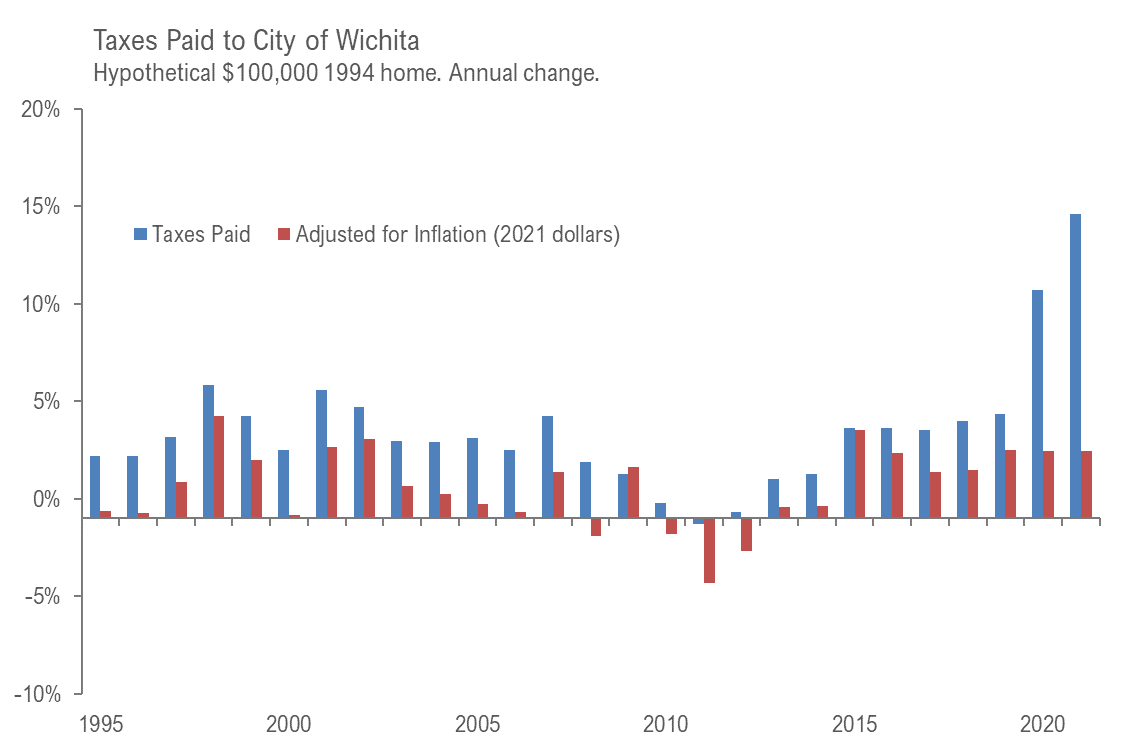

Wichita Property Tax Rate Up Just A Little

Thomas County Sales Tax Increase Kansas Tax Firm

Kansas Sales Tax Calculator And Local Rates 2021 Wise

Ford Edge Lease Offers Prices Wichita Ks

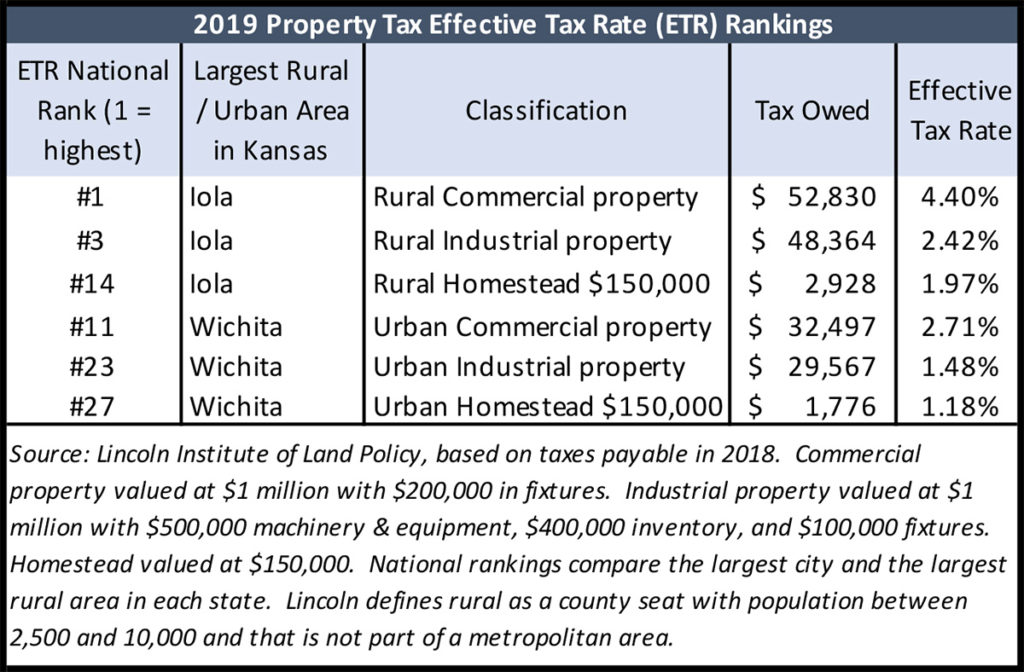

5 Things You Need To Know About Property Taxes In Kansas Kansas Policy Institute

City Of Wichita Kansas Crews Associates Inc

State And Local Sales Tax Rates 2019 Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Kansas Sales Tax Update Wayfair Safe Harbor Wichita Cpa