open end mortgage real estate

For example lets say borrower takes out a loan for 100000 that the lender secures with a. Open-end mortgages are distinct in that they are a loan agreement secured by a real estate property with funds going solely toward investment in that property.

Open End Mortgage Loan What Is It And How It Works

See pricing and listing details of Piscataway real estate for sale.

. An open-end mortgage acts as a lien on the property described in the mortgage. An open-end mortgage acts as a lien on the property described in the mortgage. See pricing and listing details of Piscataway real estate for sale.

View 174 homes for sale in Piscataway NJ at a median listing home price of 447000. Zillow has 66 homes for sale in Piscataway NJ. For example lets say borrower takes out a loan for 100000 that the lender secures with a mortgage and.

Another advantage is that the mortgagor saves all. Its circularity makes it more manageable as it doesnt have an end date. Centrally located 5-bedroom 2 full bath Bi-Level home on a lovely quiet street- convenient to all - NJ Transit Dunellen Station highways shopping schools.

An open-end mortgage is a sort of home loan in which the entire loan amount is not advanced all at once but rather used as needed. Open End MortgageA mortgage containing a clause which permits the mortgagor to borrow additional money up to the original amount of the loan after. It also has functions similar to a revolving loan.

The open-end mortgage also allows the borrower to apply for additional funds without going through the loan application process afresh. However open-end mortgages are a less common type of home loan. An open-ended mortgage can be compared to a term loan with a delayed drawing option.

Open-ended mortgages are unique. View listing photos review sales history and use our detailed real estate filters to find the perfect place. Save my name email and website in this browser for the next time I comment.

Real Estate Glossary Term Open-end mortgage. A mortgage loan expandable by increments up to maximum dollar amount all of which is secured by the same original mortgage. You get the open-end loan use the money you need pay it back.

An open-end loan is a more circular type of loan. After closing taking the view that open-ended real estate funds were also entitled to the Reduction UBS Real Estate filed a refund claim with the Italian Tax Authorities ITA for. Open-end Mortgage Mortgage loan that allowsborrowers to request additional funds from thelender up to a certain pre-determined limiteven re-borrowing part of the debt that hasbeen.

View 173 homes for sale in Piscataway NJ at a median listing home price of 447000. With an open-end mortgage borrowers take a loan for the maximum amount they qualify for even if. In contrast to standard mortgage loans.

Mortgage Loans Interest Rates Lenders Everything To Know Los Angeles Times

Loan Loan Mortgage And Banking

Real Estate Principles And Practices Chapter 11 Financing C 2014 Oncourse Learning Ppt Download

Scotsman Guide Trusted Mortgage Connections Trends News Scotsman Guide

Complaint Filing Fee For Each Cause Of Action Orc 2303 20 A December 10 2009 Trellis

2015 Oncourse Learning Chapter 9 Real Estate Finance Practices And Closing Transactions Ppt Download

Open End Mortgage Loan What Is It And How It Works

Free 9 Sample Note Agreement Templates In Pdf Ms Word

Will Real Estate Ever Be Normal Again The New York Times

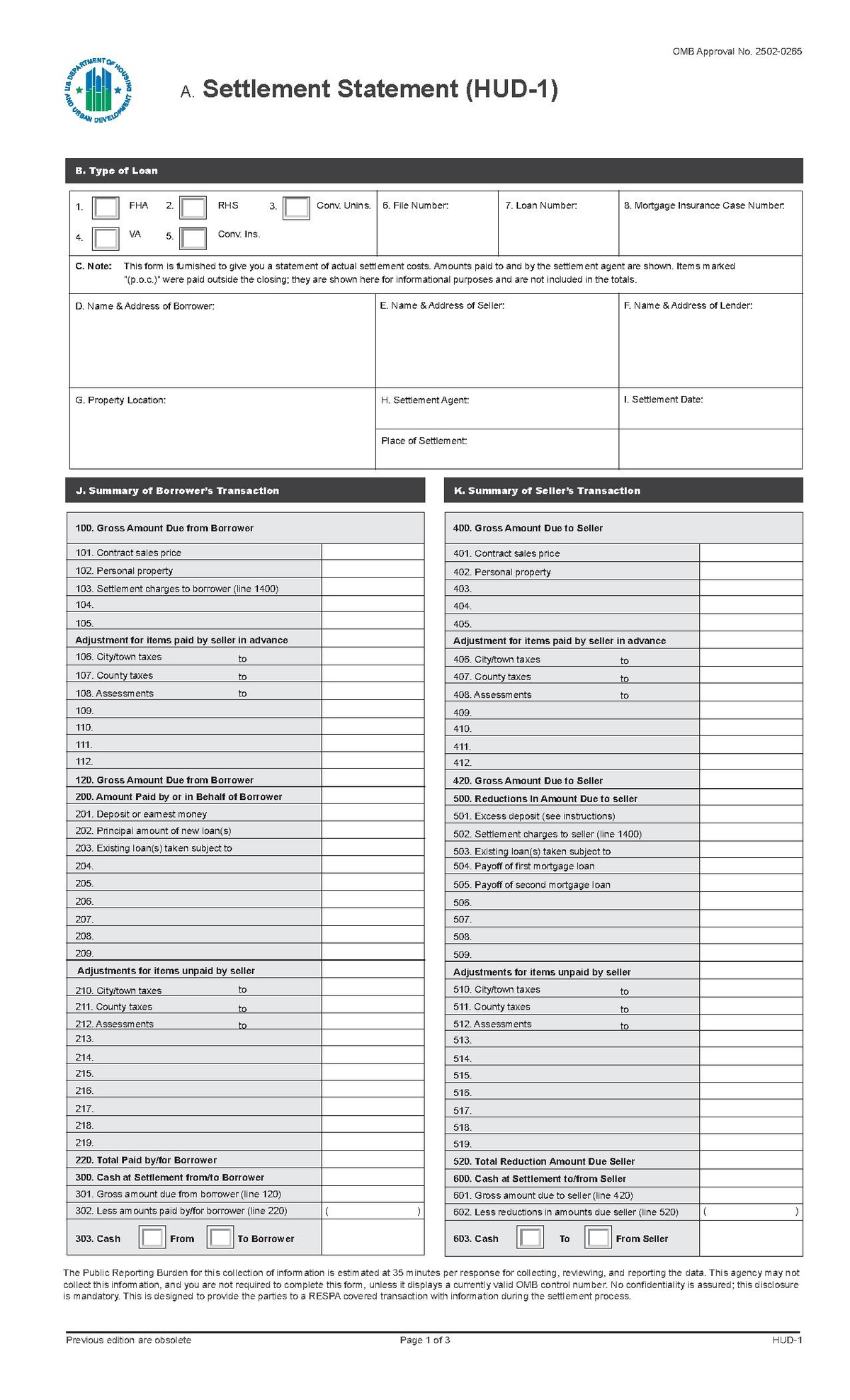

Hud 1 Settlement Statement Wikipedia

Open End Real Estate Mortgage Principles Of Microeconomics Econ 101 Study Notes Economics Docsity

Wild Swings In Mortgage Rates Last Week Caused A Rare Surge In Refinancing

Open End Mortgage Loan What Is It And How It Works

What Is Open End Mortgage Definition Of Open End Mortgage Open End Mortgage Meaning The Economic Times

First Federal Savings Bank Mortgage Loan Application Construction Loan Flyer

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)

:max_bytes(150000):strip_icc()/threepeopleworkingatdesk-69764d55562148a0bee140c5965f89a8.jpeg)